It is very important that you are using the correct GST Accounting Basis. If you are not sure which method is right for your business, please check with your Accountant or Bookkeeper. Idealpos will retrieve the GST Accounting Basis type when importing the chart of accounts.

To check your GST Accounting Basis in MYOB:

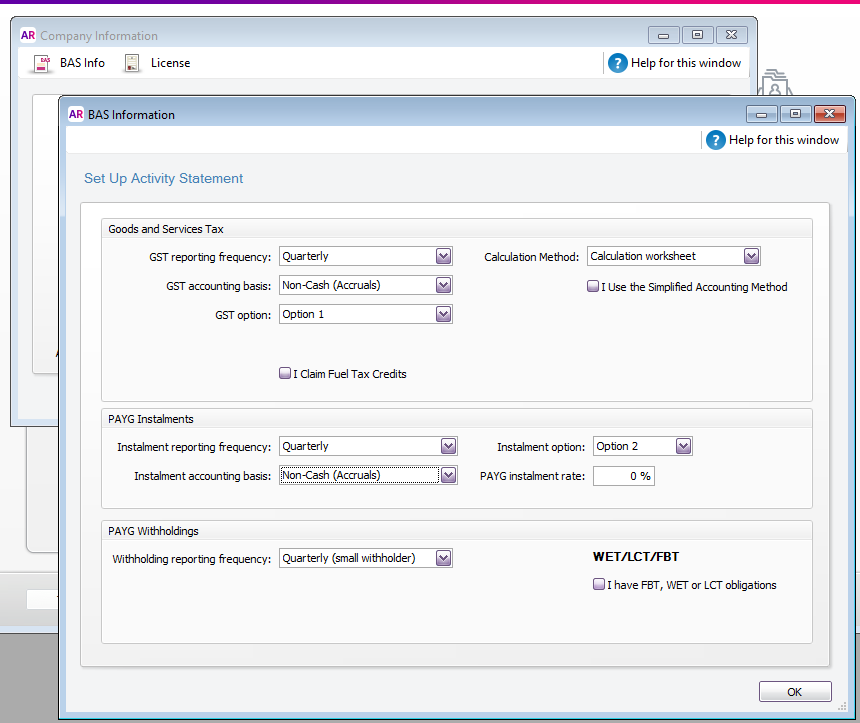

In MYOB, go to Setup > Company Information and click on the ‘BAS Info’ Icon and check the GST Accounting Basis.

To assign your GST Account basis in POS:

In POS, go to Setup > Global Options > Miscellaneous > Financial and tick the appropriate ‘GST Accounting’ option

Explanation of Cash and Accrual GST Accounting Basis

Reporting Tax on a Cash basis – GST is reportable when payments are made or received by the business, regardless of whether the transaction is pending or finalised.

Reporting Tax on an Accrual basis – GST is reportable when the transaction is considered to be finalised, regardless of payments made or received by the business.

In some GST postings, MYOB handles it itself and puts it in its designated GST account, we don’t have control over the specific account.